wake county nc sales tax rate 2019

The wake county sales tax is collected by the. This is the total of state and county sales tax rates.

Thomas Birdsey Aams Client Advisor Bessemer Trust Linkedin

There is no applicable city tax.

. A motor vehicle with a value of 8500. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. You can print a 725 sales tax table here.

A Transit Improvement Area sales tax increase affected rates in. Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh is the county seat authorized a rate increase in 2017 as did officials in Albuquerque New Mexico and the District of Columbia in 2018. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

For tax rates in other cities. There is no applicable city tax. The Wake County sales tax rate is.

You can print a 725 sales tax table here. The latest sales tax rate for Wake Forest NC. Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest.

County Rates with Effective Dates as of October 1 2016. The December 2020 total local sales tax rate was also 7250. Individual income tax refund inquiries.

County Rates with Effective Dates as of April 1 2019. The property is not located in a municipality but is in a Fire District. Historical Total General State Local and Transit Sales and Use Tax Rates.

County rate 6195 Fire District rate 1027 Combined Rate 7222 No vehicle fee is charged if the property is not in a municipality. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. There are a total of 458 local tax.

025 lower than the maximum sales tax in NC. The minimum combined 2022 sales tax rate for wake county north carolina is. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

Wake County Sales Tax Rates for 2022. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance.

Sales and Use Tax Rates Effective October 1 2022. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Sales and Use Tax Rates Effective October 1 2022.

Wake County collects on average 081 of a propertys assessed fair market value as property tax. You can find more tax rates and allowances for Wake County and North Carolina in the 2022 North Carolina Tax Tables. Pay tax bills online file business listings and gross receipts sales.

County rate 6195 Raleigh rate 3930 Combined Rate 10125 Recycling Fee 20. The Wake County Sales Tax is collected by the merchant on all. This rate includes any state county city and local sales taxes.

See it in Action. 35 rows Listed below by county are the total 475 State rate plus applicable. Search real estate and property tax bills.

This table shows the total sales tax rates for all cities and towns in. Avalara calculates collects files remits sales tax returns for your business. The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. If you need access to a database of all North Carolina local sales tax rates visit the sales tax data page. View statistics parcel data and tax bill files.

Historical County Sales and Use Tax Rates. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in order of median property taxes. The North Carolina state sales tax rate is currently.

North Carolina Department of Revenue. 2022 List of North Carolina Local Sales Tax Rates. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Sales and Use Tax Rates Effective October 1 2022.

County Rates with Effective Dates as of October 1 2020. County Rates with Effective Dates as of October 1 2018. Learn about listing and appraisal methods appeals and tax relief.

County Rates with Effective Dates as of July 1 2020. Lowest sales tax 675 Highest sales tax 75 North Carolina Sales Tax. The current total local sales tax rate in Wake County NC is 7250.

PO Box 25000 Raleigh NC 27640-0640. The total sales tax rate in any given location can be broken down into state county city and special district rates. For tax rates in other cities see North Carolina sales taxes by city and county.

Historical County Sales and Use Tax Rates. Average Sales Tax With Local. 2020 rates included for use while preparing your income tax deduction.

The 2018 United States Supreme Court decision in.

What Time Is It In North Carolina And 20 Other Internet Questions About The Tar Heel State

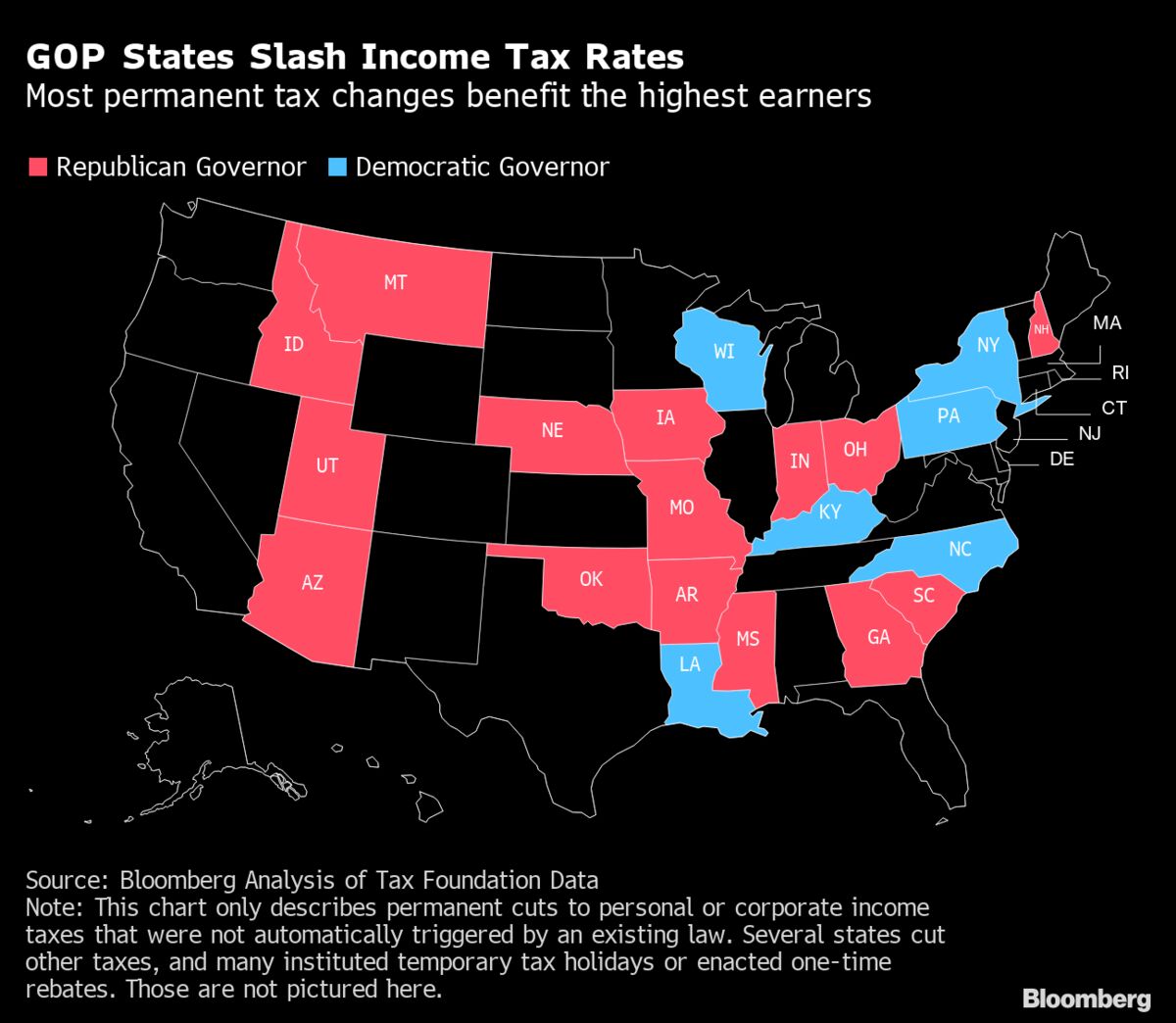

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Wake County Nc Property Tax Calculator Smartasset

Nc Lawmakers Turn To Sales Taxes To Boost Road Funding Wral Com

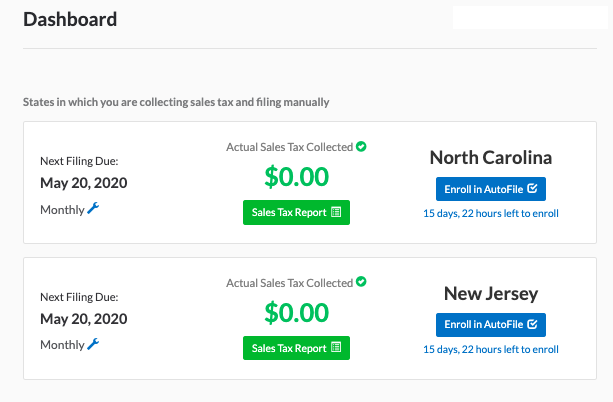

Taxjar Review Ecommerce Platform Reviews Pricing More

Complete List Of Tax Deed States

North Carolina Takes On Carbon Taxes Vertex Inc

What S The Cost Of Living In Raleigh North Carolina

Complete List Of Tax Deed States

Sales Taxes The Ultimate Guide For Small Business Owners

13217 Reunion St Charlotte Nc 28278 Mls 3492388 Zillow Zillow Home Inspector Foreclosures

Vaping Taxes In The United States And Around The World Vaping360

Nc Lawmakers Turn To Sales Taxes To Boost Road Funding Wral Com

North Carolina Mortgage Calculator Smartasset

Nc Lawmakers Turn To Sales Taxes To Boost Road Funding Wral Com

Complete List Of Tax Deed States

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg